Government Sponsored Healthcare Insurance

Government support for insurance began during World War II. In the 1942 Stabilization Act, Congress put a limit on wage increases while opening the door for employee insurance plans. This was great for expanding corporations as health benefit packages served as a means of securing workers. Two major rulings, the 1945 ruling by the War Labor Board and the 1949 ruling by the National Labor Relations Board that stated "wages" included pension and insurance benefits, further reinforced the employer-provided health insurance system. After the 40s, when negotiating for wages, employers and employees usually talked about payment in terms of salary and benefit packages.

Possibly the most compelling part of government mediation that formed the business based arrangement of medical coverage was the tax treatment of employer-provided contributions to employee health insurance plans. This was big because employers didn't need to pay finance charges on their commitments to worker health plans, meaning the employers would save immensely off these tax free payments. Additionally, employees did not have to pay income tax on their employer's contributions to their health insurance plans. In the end, both the employer and employee could save a considerable amount of money.

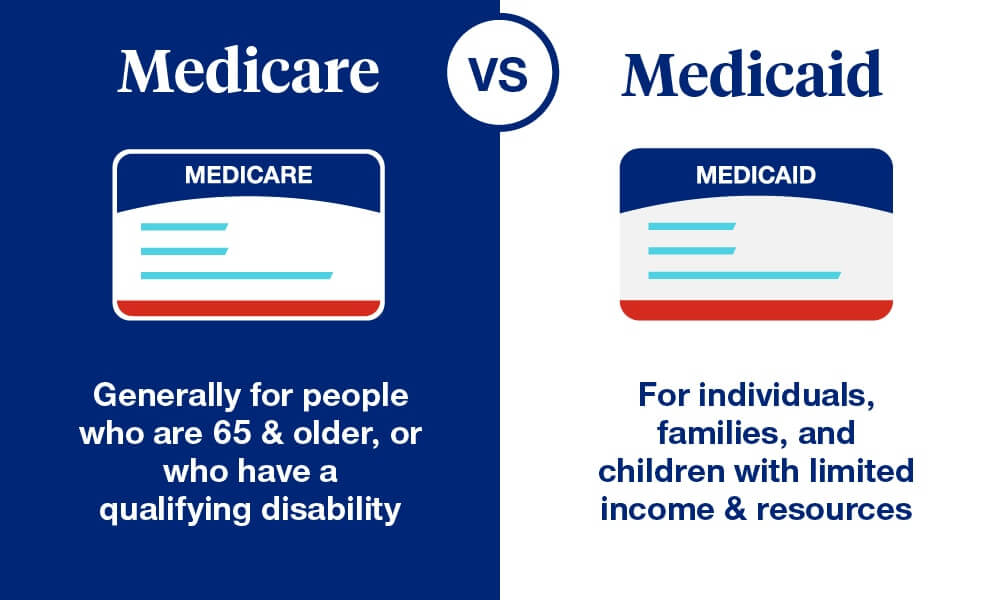

Medicare and Medicaid began as a way to counter criticisms of government-sponsored health insurance. The government hoped that by focusing on the elderly and less fortunate, they could disprove those who believed nationalized health insurance would only provide healthcare to individuals who were generally able to pay for it themselves. The implementation of these new government programs started in the 60s with Presidents John F Kennedy and Lyndon B Johnson. The political atmosphere became much more favorable towards the idea of nationalized health insurance after John F. Kennedy was elected to office in 1960 and when the Democrats won a Congress majority in 1964.

Passed in 1965, Medicare was a federal program with two parts. The first part included the obligatory hospital insurance program for all Americans age 65 or older. The second part provided supplemental medical insurance or subsidized insurance for physicians' services. This meant that doctors could bill their patients directly and the patients would have to go to Medicare to get reimbursed. Doctors and physicians used this to their advantage, charging patients more than what the program would pay and forcing patients to pay the difference. In general, funding for Medicare comes from payroll taxes, income taxes, trust fund interest, and enrollment premiums. Medicare has grown from serving 19.1 million recipients in 1966 to 39.5 million in 1999. In general, funding for Medicare comes from payroll taxes, income taxes, trust fund interest, and enrollment premiums. From 1966-99 Medicare went from serving 19.1 million to 39.5 million.

Unlike Medicare, Medicaid was enacted as a means-tested, federal-state program to supply healthcare for the impoverished. Government funding for a state's Medicaid program is proportional to the state's and national per capita income. "In contrast to Medicare, which has uniform national benefits and eligibility standards, the federal government only specifies minimum standards for Medicaid; each of the states is responsible for determining eligibility and benefits within these broad guidelines" (Thomasson). Population under Medicaid grew from 10 million to 37.5 from 1966-99.

Sources Cited:

https://www.hhs.gov/programs/health-insurance/index.html

https://eh.net/encyclopedia/health-insurance-in-the-united-states/